Many businesses carry insurance to protect them from cyber risks, but most people don’t know that you can also get Personal Cyber Protection. Several insurance companies now offer a Cyber Endorsement on their homeowners policies. If your home policy doesn’t offer that coverage, there are separate policies you can purchase to cover your cyber risks.

How Common are Cyber Attacks?

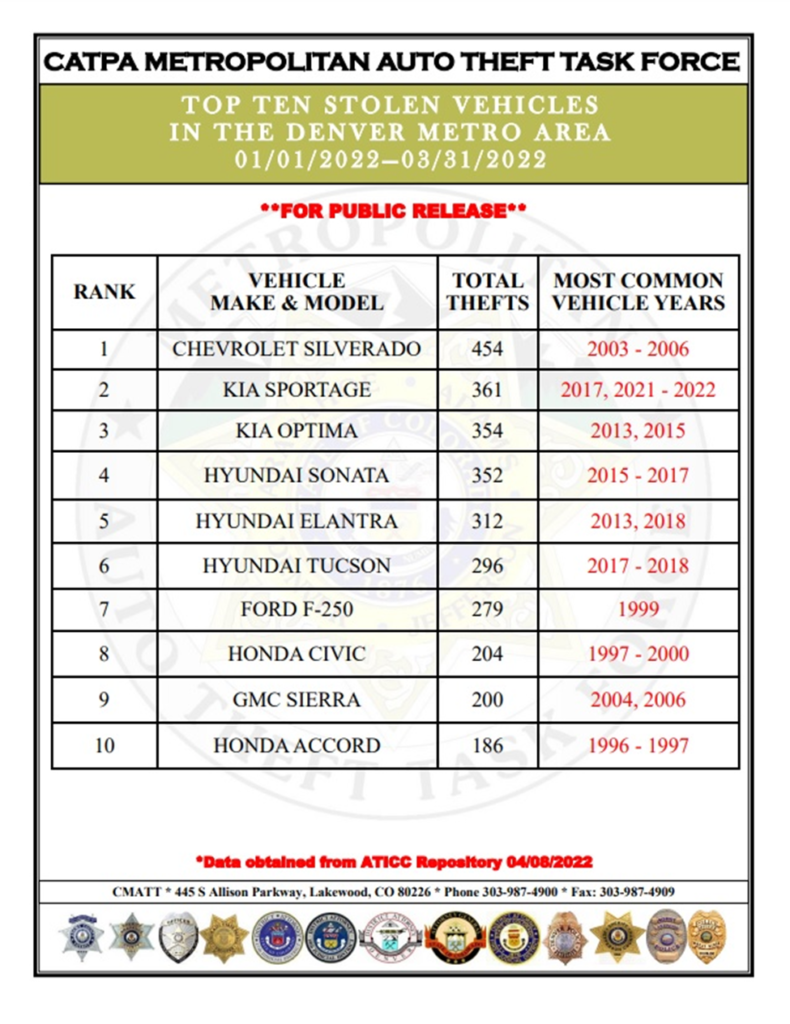

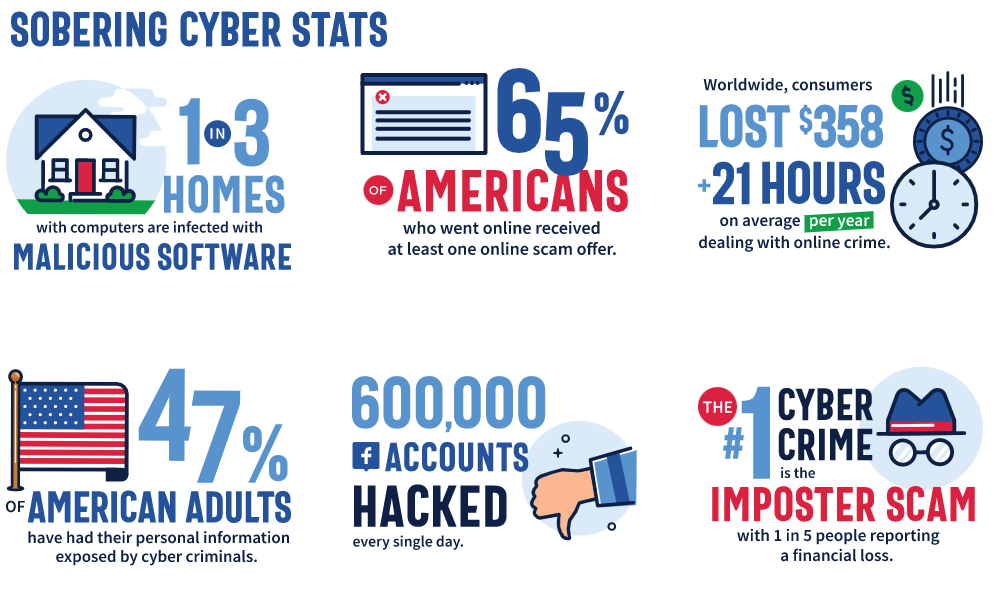

In 2021 alone, there were 847,376 complaints of cyber attacks reported to the International Crime Complaint Center. With those complaints, the potential losses exceeded $6.9 Billion.

According to Forbes, there are more than 4,000 ransomware attacks every day in the United States. That’s a 300% increase in ransomware attacks since 2015.

Who Needs Cyber Protection?

With the number of smart devices in most homes, nearly everyone has some amount of cyber risk and could benefit from coverage for cyber losses. If you fall into any of the categories below, cyber insurance might be useful for you and your family.

Anyone with:

- Home security cameras

- Smart appliances

- Amazon Alexa or other smart devices

- Smart phones

- Gaming systems

People who use:

- Online banking

- Venmo or PayPayl

- Social Media (or children with social media)

- Online shopping

- Apps that link with bank account or credit card information

The more smart devices you have, the greater the chance you have of getting targeted by a cyber criminal. You could lose privacy, money, a sense of security, your reputation and more. Cyber coverage can’t prevent a cyber crime from happening, but it can help make you whole again if you’ve been targeted.

What Does Cyber Insurance Cover?

Each insurance company may offer different variations of coverage for cyber risks, though most will offer some combination of the following.

Identity Recovery

If your identity is stolen, Identity Recovery coverage help to cover the costs associated, including legal fees, notary fees, credit bureau reports, and possibly a case manager to help guide you through the recovery process.

Cyber Extortion

Cyber Extortion is the demand for money or something else based on a credible threat to damage, disable or deny access to a device, system or data. One example is a hacker locking someone out of their computer and only returning access if they pay a ransom.

With coverage for Cyber Extortion, you’ll be provided professional assistance from an expert in the matter who will help you respond to a threat. In certain cases, your policy may also pay the ransom for the extortion threat.

Cyber Attack

A Cyber Attack is a malware attack against or unauthorized use of a computer or other connected home device.

Cyber Attack coverage can help pay for the cost of a professional firm to replace lost or corrupted data and restore the device to its original state.

Data Breach

If there is a breach where personally identifying or sensitive information is lost, stolen or released, Data Breach coverage can help resolve the situation. Coverage includes a forensic IT review to determine the extent of the breach, legal counsel to develop a response, and can help pay the cost to notify affected individuals.

Fraud

Fraud includes unauthorized use of a card, card number, account number or forgery of a check. Fraud coverage helps reimburse the insured for the resulting financial loss.

Cyberbullying

Cyberbullying is the use of electronic communication to bully a person by sending, posting or sharing negative, harmful, false or mean content.

There are a select few companies that include coverage for Cyberbullying in their Cyber protection. If Cyberbullying coverage is provided, it can cover mental health counseling, temporary relocation expenses, private tutoring and enrollment expenses if a student needs to relocate to an alternative school.

If you’d like to discuss your cyber insurance options, give us a call. We’re happy to walk you through the coverage and help you find the right fit for your family.

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

Sources:

2021 Internet Crime Report. Internet Crime Complaint Center. (n.d.). Retrieved September 7, 2022, from https://www.ic3.gov/Media/PDF/AnnualReport/2021_IC3Report.pdf

Metz, J. (2022, June 7). Do you need personal cyber insurance for cyberattacks? Forbes. Retrieved September 7, 2022, from https://www.forbes.com/advisor/homeowners-insurance/personal-cyber-insurance/