What is an E-bike?

According to Colorado Parks & Wildlife, an E-bike has 2 or 3 wheels, fully operable pedals, and an electric motor that doesn’t exceed 750 watts of power.

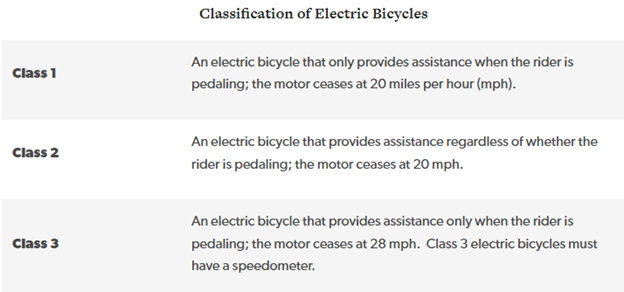

There are 3 classes of E-bikes:

Important Colorado E-bike laws:

- Electronic bicycles are not required to be registered

- There are no license requirements for E-bikes

- Generally speaking, Class 1 and 2 E-bikes are allowed to operate on the same paths as conventional bikes, thought local jurisdictions can prohibit operation on specific paths

- Class 3 E-bikes are only allowed on streets and bike lanes, unless specifically permitted by local jurisdictions

- There are different rules pertaining to State Park or Wildlife Areas

- E-bikes must ride in the right-hand lane when traveling a less than the normal speed of traffic on a roadway

- Riders must signal intent to turn or stop and yield the right of way to pedestrians

- One hand must be kept on the handlebars at all times

- Class 3 E-bikes have the following age and helmet restrictions:

- Operators must be 16 or older (passengers can be under 16)

- Operators and passengers under 18 must wear a helmet

Does an E-bike have to be insured?

The short answer is no. There aren’t any legal requirements to insure an E-bike. That being said, if you have a loan on an E-bike, your lender will likely require you to carry insurance on it.

Even though you’re not required to have insurance on an E-bike, it’s important to at least have liability coverage. You can go faster on an E-bike than you might otherwise travel on a conventional bike, which makes the risk of crashing a little higher. If you hit a person, fence, house, mailbox, or something else, you could be responsible for the damages. Liability insurance will help you pay for those damages if a situation like that arises.

If you’ve paid a pretty penny for your E-bike, it probably makes sense to get adequate insurance for it. That way if it gets stolen, damaged in a fire, you’re in an accident, or something else happens, you’re not left empty handed.

How to insure an E-bike:

Many homeowners policies will afford some amount of coverage for an E-bike. Some policies may only extend liability, whereas others have a special limit of physical damage coverage included and some may not extend any coverage at all. Each insurance carrier has their own guidelines, so be sure to check what coverage you have on your policy.

Keep in mind that most home policies have a deductible of $1,000 or higher, so if you’re counting on your home policy to cover any damages to your bike you’ll need to cover your deductible before your policy pays out. Depending on the value of your E-bike and your home insurance deductible, it might not make sense to insure it on your home policy.

Many E-bikes cost several thousand dollars, so a total loss might exceed your deductible. But if a $1,200 E-bike was stolen, that’s not a claim I’d recommend filing on a home policy. You’d only get $200 from that claim example, which isn’t worth having a claim against your home insurance since it would likely cause your premium to increase for up to 5 years.

If you don’t have a home policy or if your policy doesn’t provide the coverage you’re looking for, you can generally insure and E-bike on a motorcycle policy. One benefit of that is that you can choose a lower deductible, like $500 or even lower.

Another plus is that you can file a claim without it impacting your home insurance. A claim for a stolen E-bike wouldn’t cause your motorcycle premium to increase like it would if you filed a claim on your home policy.

Insuring an E-bike on a motorcycle policy would also give you the option of Medical Payments and Uninsured Motorist coverage, both of which can be extremely valuable. Medical Payments coverage can help pay for your injuries, regardless of whether you’re at fault for a loss. The limit is usually $5,000 per person, but limits can vary.

Uninsured Motorist coverage will help cover your costs if you’re not at-fault for in an accident and the other person doesn’t have enough coverage. You can get Uninsured Motorist coverage up to the bodily injury liability limits on your motorcycle policy.

Read more about Uninsured Motorist coverage: What is Uninsured Motorist Coverage?

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

Sources:

Colorado Parks & Wildlife. Colorado Parks and Wildlife. (n.d.). Retrieved June 27, 2022, from https://cpw.state.co.us/thingstodo/Pages/E-Bike-Rules.aspx

Electric Bicycles. Electric Bicycles | Colorado General Assembly. (n.d.). Retrieved June 27, 2022, from https://leg.colorado.gov/content/electric-bicycles