Across the insurance industry, rates are expected to increase even more this year than they have in recent years. While annual increases are becoming the norm, the jump may be more drastic in 2022.

There are many factors that are driving insurance costs up. Claim payouts are higher than ever, and natural disasters and car accidents are becoming more frequent. Combine that with supply chain issues and labor shortages, and you have the unprecedented market we’re currently in.

Homeowners

Building material costs are at an all-time high

With global supply chain issues and labor shortages, prices for many products have soared over the past few years. Building materials are no exception.

During the first year of the pandemic, the cost of lumber jumped up by 42%. The prices have fluctuated since, but aren’t back to the pre-pandemic prices. In the first three quarters of 2021, steel mill products rose in cost by 81%.

There’s also currently a shortage of at least 200,000 skilled trade workers. 60% of surveyed builders are reporting labor shortages and the vast majority of them don’t expect that problem to go away in the next 6 months.

Price increases from December 2020 – December 2021:

Floor Coverings 3.9%

Window Coverings 8%

Major Appliances 6%

Overall Construction Supplies 18.4%

All of these factors have led to more expensive construction projects for both home repairs and new construction.

Home claims are rising in both severity and frequency

Catastrophic home claims are no longer few and far between, they seem to be happening every other week somewhere in the country.

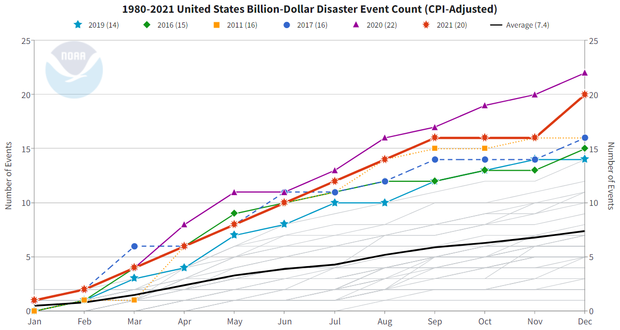

In 2021, there were 20 natural disasters with losses exceeding $1Billion in the US alone. From 1980-2021 the annual average is 7.4 events, but the annual average in the past 5 years is 17.2 events.

Many scientists and experts attribute the increased frequency of disastrous events to climate change. As our weather and climate changes, severe weather events are becoming more common and severe.

Between the increased frequency and severity of home claims and the higher cost of building materials, home insurance prices will continue to increase. The chances that you’ll need to file a claim on your home are higher, and it will cost even more to repair or rebuild your home than it has previously.

Auto

Supply chain disruptions are causing costly shortages

Supply chain issues are impacting many different industries, including auto production. 7.7 Million fewer vehicles were produced in 2021 due to supply chain complications.

One of the most impactful shortages has been microchips that are used in vehicles. With most vehicles containing higher levels of technology than ever before, it’s been difficult for manufacturers to keep up with demand.

Because of the microchip shortage, there’s a shortfall of new vehicles on the market, which has driven up the cost of used vehicles.

Price increases from December 2020 – December 2021:

New Vehicles 11.8%

Used Vehicles 37.3%

Many rental car companies sold a large portion of their vehicles in order to survive during the pandemic. Once travel increased again over the summer of 2021, they had to restock their fleet of vehicles. With fewer new vehicles on the market due, they turned to used vehicles.

Around the same time, consumers who had extra money from stimulus checks also began shopping for new and used cars. The combination of that and the rental car companies drove the prices of used vehicles up significantly in June. Those prices remained inflated through the end of 2021 and aren’t expected to drop anytime soon.

The cost to repair vehicles keeps rising

In addition to the microchips, there are also supply chain issues impacting wiring harnesses, plastics, and glass used by auto manufacturers. As a result, the cost to repair vehicles is up around 20% and the cost of auto parts is up 6%.

Similar to the skilled labor shortage seen in the construction industry, there’s also a need for 3 times as many trained auto technicians. The delays in obtaining auto parts and the lack of skilled technicians to complete the repairs have made auto repairs take significantly longer.

With cars being stuck in the shop for longer than usual, that takes up even more of the rental car market. People are needing rental cars for longer, and they are harder to find. That drives the cost of rental cars up and exhausts the car insurance coverage limits faster.

Driving has returned to pre-pandemic levels

At the beginning of the pandemic there were fewer drivers on the roads and there were fewer accidents as a result. During that time, many insurance companies decreased premiums and offered credits or refunds.

In 2021, however, we saw a return to pre-pandemic driving levels and a rise in the number and severity of accidents. Insurance companies found themselves with underpriced policies, which is causing them to now increase rates to keep up with the high claim payouts.

If you’d like to discuss your insurance options or get a proposal, give us a call today. We’re here to help!

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

Sources:

Semiconductor shortages to cost the auto industry billions. AlixPartners. (2021, September 23). Retrieved January 27, 2022, from https://www.alixpartners.com/media-center/press-releases/press-release-shortages-related-to-semiconductors-to-cost-the-auto-industry-210-billion-in-revenues-this-year-says-new-alixpartners-forecast/

Smith, A. B. (2022, January 24). 2021 U.S. billion-dollar weather and climate disasters in historical context. 2021 U.S. billion-dollar weather and climate disasters in historical context | NOAA Climate.gov. Retrieved January 27, 2022, from https://www.climate.gov/news-features/blogs/beyond-data/2021-us-billion-dollar-weather-and-climate-disasters-historical

U.S. Bureau of Labor Statistics. (2022, January 12). Table 2. consumer price index for all urban consumers (CPI-U): U. S. city average, by detailed expenditure Category – 2021 M12 results. U.S. Bureau of Labor Statistics. Retrieved January 27, 2022, from https://www.bls.gov/news.release/cpi.t02.htm

NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2022). https://www.ncdc.noaa.gov/billions/, DOI: 10.25921/stkw-7w73

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind