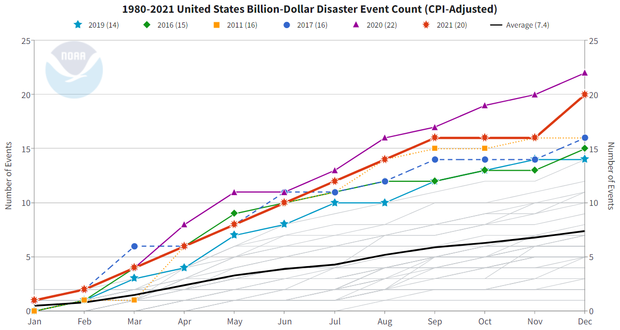

1. Volatile Catastrophe Trends

In the insurance industry, a “catastrophe” is a disaster that is unusually severe and meets or exceeds a loss threshold. As of December, 2021, the current dollar threshold to declare an event a catastrophe is $25 Million, according to Insurance Information Institute. Some examples of catastrophic events include tornadoes, hailstorms, high wind, flooding, hurricanes and wildfires.

Colorado does see some flooding and tornadoes, but the largest losses come from wildfires and hailstorms. Colorado has the 3rd highest wildfire risk in the US and had the 2nd most hail claims filed between 2018-2020.

Wildfire

Insurance Information Institute reported that as of October, 2021, Colorado has 373,900 properties with “high to extreme wildfire risk.” That makes up 17% of the properties in the state. With so many properties at risk of being damaged or destroyed by wildfire, insurance companies have to plan accordingly.

Colorado’s highest catastrophic payouts since 2017:

May 8, 2017 Denver Metro Hailstorm: $2.3 Billion

2018 Front Range & CO Springs Top 3 Hailstorms: $276.4 Million, $169 Million, $172.8 Million

2020 East Troublesome Fire: $543 Million

2021 Marshall Fire: Over 1000 structures destroyed and estimated $1 Billion in damages

Catastrophe Facts and Statistics- RMIIA

The high wildfire risk in Colorado means higher rates across the state. But insurance companies charge more for insurance on homes that have the highest risk. They do this by assigning each property a Protection Class (PC) or Brushfire Score, which determines the risk of fire and the responding fire department’s ease of access and resources. The higher the PC or Brushfire Score, the higher the premium charged to insure that property.

Read more: What You Should Know About Wildfires and Insurance

Colorado has the 3rd highest wildfire risk in the US and had the 2nd most hail claims filed between 2018-2020.

Hail

Hail has been a problem in Colorado for as long as I can remember, but the number and severity of claims have increased significantly over the past decade. Part of that is due to the increasing population in the state. The more homes that are built on the Front Range, the more targets there are for hail to hit.

Between January 1, 2017 and December 31, 2019, Denver and Colorado Springs were in the top 5 cities for hail losses, with Denver at #2 and Colorado Springs at #3, according to an Insurance Journal article. Insurance companies in Colorado pay out hundreds of millions, if not over a billion dollars for hail damage every single year. Most companies have higher deductibles for wind and hail losses to help mitigate the risk. They also have to charge an adequate amount for both auto and home insurance.

2. Traffic Accidents

There are three major factors causing the number and severity of traffic accidents to rise in Colorado: Booming Population, Impaired Driving, and Distracted Driving.

Population Growth

It’s no secret that the population in Colorado is increasing at a rapid rate. According to U.S. News, the 2020 Census showed that Colorado was 6th fastest-growing state from 2010-2020, with a 14.8% growth. Unfortunately, traffic infrastructure has not kept pace with the population growth, leaving many roads on the front range gridlocked more frequently than not. More cars on the road directly correlates with accident frequency.

Distracted Driving

In addition to the heavier traffic, dangerous driving activities are becoming more common. Nearly everyone has a smart phone, and most people don’t put their phone on “Do Not Disturb” when they get behind the wheel. Distracted driving can include anything that takes focus away from the road, including texting, talking on the phone, eating, reading, and more.

According to CDOT’s 2021 annual survey:

91% of participants reported driving distracted in the past seven days.

54% admitted to reading a message on their phones.

Nearly 50% talked on a cell phone while driving.

41% sent a message while driving.

CDOT also reported that in 2020, 10,166 crashes in Colorado involved distracted drivers. Those accidents caused 1,476 injuries and 68 deaths.

Impaired Driving

Impaired driving is also contributing to more severe and frequent accidents. The total number of fatal crashes has increased by 37% from 2011 to 2021. Fatalities involving drivers that tested positive for drugs increased by 39.3% from 2015 to 2019. Drivers with a BAC over the legal limit were involved in 8.6% more fatal accidents during that same time.

From 2020 to 2021, the number of DUIs involving marijuana went up by 48%. While not all DUI incidents end in an accident, the increase in risky driving behavior certainly impacts the frequency of crashes.

With impaired and distracted driving causing more crashes, injuries and fatalities, insurance companies are paying out more for auto claims in Colorado. Higher medical costs are also impacting the higher payouts for auto accidents. Berkley Accident and Health reported that treatment costs increased by 6% in 2020 and another 7% in 2021.

Unfortunately when accident frequency and severity increases, we all pay the price. The more insurance companies pay out in claims, the more rate increases they are forced to take in order to remain solvent in the state.

3. Supply Shortages

There have been worldwide supply shortages since the pandemic started in 2020, which have led to inflated prices across most industries. Since the materials for home construction and auto parts are more expensive, insurance payouts are also inflated.

Auto Part Shortages

According to the Consumer Price Index, the cost of auto parts have increased by 14.2% from March 2021-March 2022. Insurance companies generally consider a vehicle a total loss if it will cost more than 70% of the vehicles value to repair the damage. That means more cars are being totaled because of the inflated repair costs.

Both new and used cars are also much more expensive than they were a few years ago. Supply chain disruptions have made it harder for manufacturers to produce enough new vehicles. There were 7.7 Million fewer vehicles produced in 2021, largely due to the microchip shortages. The shortfall of new vehicles directly impacts the price of used vehicles.

Price increases from March 2021 – March 2022:

New Vehicles: 12.5%

Used Vehicles: 35.3%

Motor Vehicle parts and equipment: 14.2%

*According to the U.S. Bureau of Labor Statistics Consumer Price Index

As the values of used vehicles increase, the payouts for total losses get higher. With insurance companies paying out more, the cost of insurance also goes up.

Building Material Shortages

On top of the rising costs impacting auto insurance, the costs of building materials have also soared because of supply chain shortages. Lumber prices jumped 42% in the first year of the pandemic, and steel mill products rose 81% in the first three quarters of 2021. Throughout 2021, the price of materials for new construction increased by over 18%.

The inflated cost of materials alone has led to much higher prices for rebuilding homes that have been damaged. Just like with auto insurance, higher home claim payouts leads to home premium increases.

On home policies, insurance companies are increasing rates to keep up with the amount they are paying out for claims but premiums are also rising due to higher coverage amounts. Since it costs more to rebuild a home, the amount of coverage you have on your home policy is likely also increasing.

There’s a good chance that if your policy was written more than a year ago, you don’t have enough coverage to rebuild your whole home.

You may have been able to rebuild your home for $150/square foot 4 or 5 years ago, but now it might cost closer to $275/square foot. As a result, your dwelling coverage (Coverage A) needs to increase to ensure your home is properly insured.

Many homeowners found out they were underinsured after the Marshall Fire, which is largely due to the rapid inflation seen in the past several years. If you haven’t review your home coverage with a licensed agent recently, I highly recommend you do. There’s a good chance that if your policy was written more than a year ago, you don’t have enough coverage to rebuild your whole home.

Read more: If Your Home Burned Down, Would You Have Enough Coverage?

4. Labor Shortages

You can walk into almost any business and see a “Help Wanted” sign on the door. It’s no secret that there are labor shortages across most industries. The shortage of workers has directly impacted the supply shortages, but even when the supplies are available many industries don’t have enough people to actually do the work.

Auto Technician Shortages

There’s currently a deficit of trained auto technicians to work on repairing damaged vehicles. To keep up with demand, there needs to be 3 times as many qualified technicians. The shortfall of auto technicians is causing higher auto repair costs and longer repair times.

When it takes longer to repair a vehicle, the insurance companies end up paying for a rental car for longer which also increases the claim payout amount.

Skilled Construction Labor Shortages

When it comes to home construction, there’s a shortfall of at least 200,000 skilled trade workers. That has led to more expensive bids for both home repairs and new construction. Not only are skilled workers charging more for their labor, but the amount insurance companies are paying for Additional Living Expenses is much higher.

Most home policies come with coverage for Additional Living Expenses, so if you can’t live in your home due to a covered loss they will pay for the additional expenses you incur as a result. That includes a hotel or long-term rental, restaurant expenses if you don’t have a kitchen to cook in, dry cleaning bills if you don’t have access to a washer and dryer, and more. If takes 6 months longer to rebuilt your home after a loss, the insurance company is paying those expenses for longer.

At the end of the day, the amount insurance companies pay out for claims directly impacts the amount they charge for insurance. All of the reasons listed above are causing insurance companies to pay out more than they have in the past. As a result, the cost of auto and home insurance are increasing accordingly.

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

- My boat is already paid for and rarely used. Should I still invest in boat insurance?

- Wondering If Homeowners Insurance Is A Smart Investment? What to Know

- Commercial Insurance: Security Upgrades For An Office Setting

- The Difference Between Classic, Historic, Vintage, and Restored Automobiles

- Recreational Drone Insurance: Flying with Peace of Mind

Sources:

Boyd, S. (2021, January 29). Marijuana Dui Arrests Up 48% In Last Year Across Colorado. CBS Denver. Retrieved April 13, 2022, from https://denver.cbslocal.com/2021/01/29/marijuana-dui-colorado-arrests-alcohol/

Catastrophe Facts & Statistics. RMIIA. (n.d.). Retrieved April 13, 2022, from http://www.rmiia.org/catastrophes_and_statistics/catastrophes.asp#:~:text=The%20most%20destructive%20wildfire%20in,and%20auto%20insurance%20claims%20filed

Davis Jr., E. (2021, April 28). 2020 census shows America’s fastest-growing states | best … U.S. News & World Report. Retrieved April 13, 2022, from https://www.usnews.com/news/best-states/slideshows/these-are-the-10-fastest-growing-states-in-america

Distracted driving. Colorado Department of Transportation. (2022, April 4). Retrieved April 13, 2022, from https://www.codot.gov/safety/distracteddriving

Facts + Statistics: Wildfires. Insurance Information Institute. (n.d.). Retrieved April 13, 2022, from https://www.iii.org/fact-statistic/facts-statistics-wildfires

Spotlight on: Catastrophes – Insurance Issues. Insurance Information Institute. (2021, December 13). Retrieved April 13, 2022, from https://www.iii.org/article/spotlight-on-catastrophes-insurance-issues

Top states, cities for insurance claims for hail damage. Insurance Journal. (2020, April 28). Retrieved April 13, 2022, from https://www.insurancejournal.com/news/national/2020/04/28/566579.htm

U.S. Bureau of Labor Statistics. (2022, April 12). Table 7. consumer price index for all urban consumers (CPI-U): U.S. city average, by expenditure category, 12-month analysis table – 2022 M03 results. U.S. Bureau of Labor Statistics. Retrieved April 13, 2022, from https://www.bls.gov/news.release/cpi.t07.htm

Unni, C. (2021, November 29). The Pandemic’s Lasting Effects: Medical Costs Projected to Rise 6.5% in 2022. Berkley Accident and Health. Retrieved April 13, 2022, from https://www.berkleyah.com/the-pandemics-lasting-effects-medical-costs-projected-to-rise-6-5-in-2022/